National Debt Clock

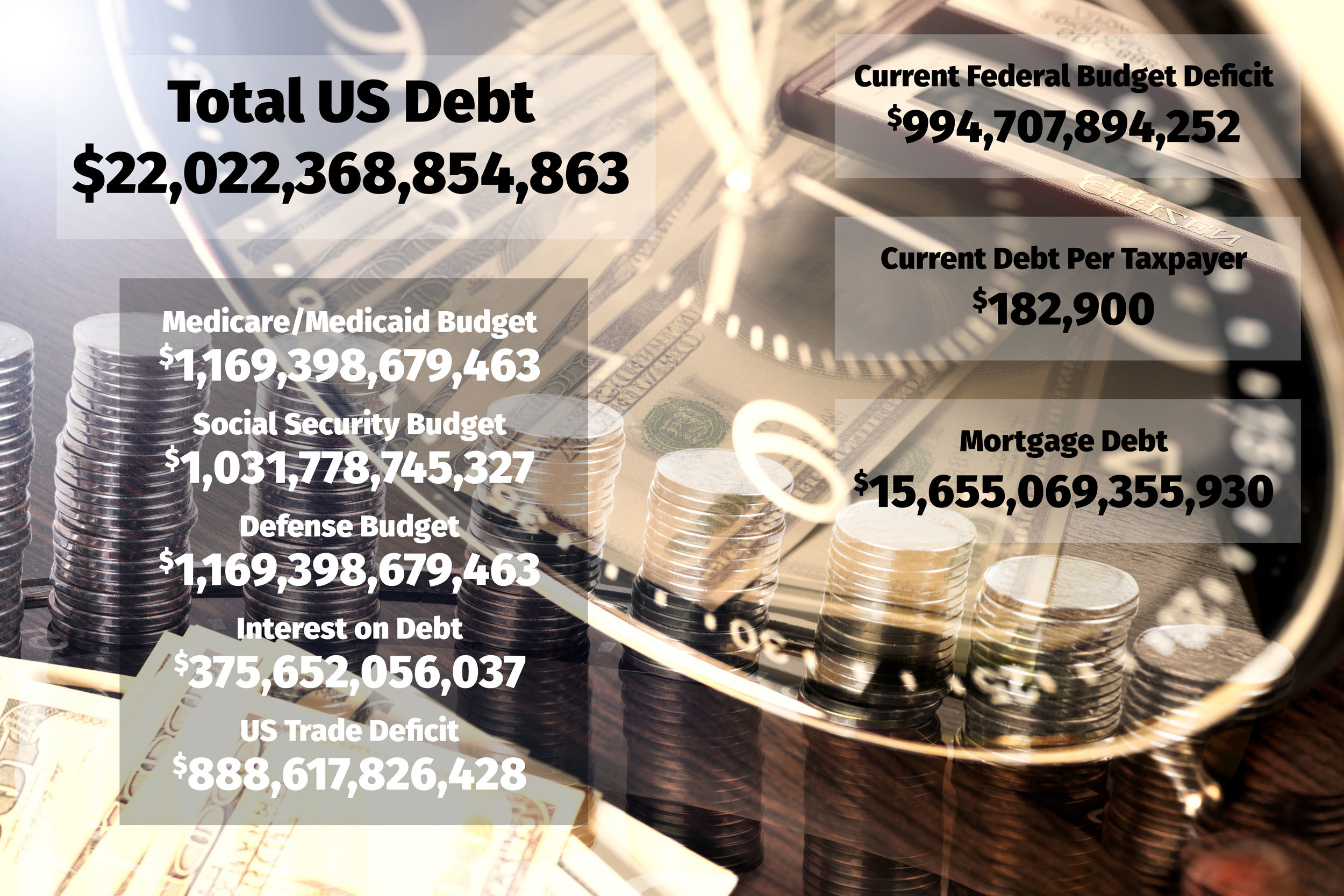

Current United States Government Debt:

$22,022,368,854,863

As of 8/01/2019 - View actual daily total on the United States Treasury’s website HERE

From Wikipedia:

The national debt of the United States is the total debt, or unpaid borrowed funds, carried by the Federal Government of the United States, which is measured as the face value of the currently outstanding Treasury securities that have been issued by the Treasuryand other federal government agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. A deficit year increases the debt, while a surplus year decreases the debt as more money is received than spent.

There are two components of gross national debt:[1]

Debt held by the public – such as Treasury securities held by investors outside the federal government, including those held by individuals, corporations, the Federal Reserve System, and foreign, state and local governments.

Debt held by government accounts or intragovernmental debt – are non-marketable Treasury securities held in accounts of programs administered by the federal government, such as the Social Security Trust Fund. Debt held by government accounts represents the cumulative surpluses, including interest earnings, of various government programs that have been invested in Treasury securities.

In general, government debt increases as a result of government spending, and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. In practice, Treasury securities are not issued or redeemed on a day-by-day basis,[2] and may also be issued or redeemed as part of the federal government's macroeconomic management operations.

Historically, the US public debt as a share of gross domestic product (GDP) has increased during wars and recessions, and subsequently declined. The ratio of debt to GDP may decrease as a result of a government surplus or due to growth of GDP and inflation. For example, debt held by the public as a share of GDP peaked just after World War II (113% of GDP in 1945), but then fell over the following 35 years. In recent decades, aging demographics and rising healthcare costs have led to concern about the long-term sustainability of the federal government's fiscal policies.[3] The aggregate, gross amount that Treasury can borrow is limited by the United States debt ceiling.[4]

As of June 2019, federal debt held by the public was $16.17 trillion and intragovernmental holdings were $5.86 trillion, for a total national debt of $22.03 trillion.[5] At the end of 2018, debt held by the public was approximately 76.4% of GDP,[6][7] and approximately 39% of the debt held by the public was owned by foreigners.[8] The United States has the largest external debt in the world. In 2017, the US debt-to-GDP ratio was ranked 43rd highest out of 207 countries.[9] The Congressional Budget Office forecast in April 2018 that debt held by the public will rise to nearly 100% of GDP by 2028, perhaps higher if current policies are extended beyond their scheduled expiration date.[10]